Schlüsselbegriffe: Wald-Biomasse, Investitionen, Rentabilität, Kurzumtriebs-plantagen

Summary

Following the Croatian fully fledged membership in the European Union in 2013 and pursuant to the Directive 2009/28/EC on the promotion and use of energy from renewable sources, Croatia, as well as other member states had done previously, committed to increasing their use of energy from renewable sources. Consequently, by 2020 the share of energy from renewable sources in final gross energy consumption is expected to reach at least 20% at EU level. According to the Energy Strategy (2009), Croatia had set a goal for 2010 to use about 15 PJ (peta joules) biomass energy, and for 2020, around 26 PJ. This energy will be generated in numerous biomass power plants with a total output of about 85 MW. In the last few years, investments in short rotation crops in Croatia have increased substantially due to the rising need for biomass. This case study evaluates investments in short rotation coppice (SRC) on the territory of the Republic of Croatia. SRC are mostly planned and established on land in rural areas which is not used for agricultural or forestry purposes due to its low site quality. The sample of plantations of willow clones (Salix sp.) studied covers an area of 3,000 ha. The time frame of the project is 15 years and the predicted annual willow yield amounts to 21 t DM ha-1 a-1 (dry mass per hectare per year). The research results presented refer to the investment launched in Valpovo Forest Range Office located in the eastern part of the Republic of Croatia. Methods of capital budgeting were used in the economic analysis (NPV-Net Present Value, IRR-Internal Rate of Return). The discount rate that was taken as a reference stood at 7 %, yet rates ranging between 5 % and 10 % were used in terms of sensitivity analysis. All the calculated indicators showed the cost-effectiveness of the project: dynamic payback period: 10.83 years, net present value: 1,789,133 € and internal rate of return 10.36 %.

Zusammenfassung

Mit Erreichen der EU-Vollmitgliedschaft 2013 hat sich Kroatien wie auch die anderen EU-Mitgliedsstaaten gemäß der Richtlinie 2009/28/EG verpflichtet, die Nutzung erneuerbarer Energie zu intensivieren. Dementsprechend soll der Anteil erneuerbarer Energie im Jahr 2020 mindestens 20 Prozent des Bruttoenergieendverbrauches auf EU-Ebene betragen. Laut Energiestrategie (2009) hatte Kroatien als Ziel für 2010 etwa 15 PJ (Peta-Joule) sowie für 2020 rund 26 PJ Energie aus Biomasse zu gewinnen. Diese Energie wird in einer größeren Zahl von Biomassekraftwerken mit einer Gesamtleistung von ca. 85 MW generiert. Aufgrund des steigenden Bedarfs an Biomasse hat sich in der letzten Zeit die Anzahl der Investitionen in Kurzumtriebsflächen in Kroatien erhöht. Die Fallstudie behandelt die Investitionsanalyse von Kurzumtriebsplantagen in Kroatien. Solche Plantagen werden größtenteils auf ertragsschwachen Böden in ländlichen Gebieten geplant und etabliert, die keiner land- oder forstwirtschaftlichen Nutzung unterliegen. Die Untersuchung bezieht sich auf gepflanzte Weidenklone (Salix sp.) im Ausmaß von 3000 ha. Die Projektlaufzeit beträgt 15 Jahre und die erwartete Produktivität liegt bei jährlich 21 t an Trockenmasse je ha. Die dargestellten Forschungsergebnisse beziehen sich auf die im Revier Valpovo im Osten Kroatiens eingeleitete Investition. Für die ökonomische Analyse wurden die klassischen Methoden der dynamischen Investitionsrechnung benutzt (Kapitalwert, interner Zinsfuß). Der als Referenz gewählte Zinsfuß beträgt 7%, wobei im Rahmen der Sensitivitätsanalyse Zinsfüße zwischen 5% und 10% angewandt wurden. Alle berechneten Indikatoren belegen die ökonomische Vorteilhaftigkeit des Projektes: dynamische Amortisationsdauer: 10,83 Jahre, Kapitalwert: 1,789.133 € und interner Zinsfuß 10.36%.

1. Introduction

A higher level of energy independence is a strategic interest of each country and hence exploration of the potential of use of alternative energy sources is considered as one of the priorities of sustainable development. The Croatian energy policy is closely linked to the energy policy of the European Union, which stipulates the commitment to reduce emissions by 20% below 1990 levels by 2020 as documented in the Amendment to the Kyoto Protocol accepted at the Conference of the Parties (COP 18) in Doha in 2012 and COP 21 in Paris. Croatia is to meet this objective along with the other EU member states (Duić et al. 2005).

Biomass from forest tree species can be produced also by intensive cultivation of fast growing species in short rotation coppice (SRC). These types of plantations are fundamentally intended for biomass production as a renewable and environmentally acceptable energy source. They can also be considered as an alternative “agricultural” crop (especially on marginal sites), contribute to diversification of agricultural production and provide an opportunity for an environmentally more acceptable way of wastewater and phytoremediation (Kajba et al. 2011). Moreover, they are intended for sequestration of an increased quantity of atmospheric carbon and the mitigation of climate change by means of carbon storage (Volk et al. 2004).

Throughout the previous research willow and poplar clones showed the greatest biomass production potential in short rotation of up to five years on marginal and especially on optimal soils (Kajba et al. 1998, Kajba & Bogdan 2003, Bogdan et al. 2006, Kajba & Andrić 2014). Consequently, testing of diverse clones of willow and poplar continued in Croatia, aiming to identify those with the greatest biomass production potential, especially on the so called marginal soil or soil where agricultural production has been abandoned and those that are unattractive concerning the cultivation of more valuable forest tree species (Kajba et al. 1998, Kajba et al. 2004, Kajba & Katičić 2011). Plantations of broad-leaved tree species can be used as pure energy plantations, pre-cultures and mixed plantations striving to produce wood chips for the production of short wood fibres and timber to meet the requirements of mechanical wood processing. Such biomass production efforts are in line with global trends that aim to enhance the use of renewable energy sources (Verwijst 2003, Volk et al. 2004, Smart et al. 2005, Rosillo-Calle 2007). Biomass implies non-fossilized plant material created through photosynthesis. Wood from trunks, crowns and branches is used upon classical forest exploitation and normally the diameter with bark exceeds 7 cm at its thinnest parts. Hence, up to 70% of wood mass of mature stands is used, while in young stands it can total up to 50% (Sušnik & Benković 2007). The allowable cut of 6.5 million m³ in Croatia results in around 2 mill. m³ of tree trunks (30 %), 650,000 m³ of cellulose (10%), 1.3 mill. m³ firewood (20%), whereas the remainder of around 2.6 mill. m³ (40 %) is small dimension wood that remains unexploited in the forests as waste. Out of the previously mentioned waste 62.5 % or 1.6 mill. m³ could be used for energy production, while 37.5% or almost 1 mill. m³ would still remain in the forests as waste. If 1.3 million m³ firewood is added, one is left with a total quantity of nearly 3 million m³ of wood for energy that could instantly be used on the energy market (Tomić et al. 2008). Intensive forest management in Croatia could increase the annual allowable cut (logging) to reach around 7.3 million m³ which would result in almost 3.3 million m³ of forest biomass for energy, which, compared with the current results, implies an increase of 2 million m³.

The specific objective of the research was to analyse the cost-effectiveness of short rotation plantations, which is one of the principal prerequisites for successful biomass production from an economic point of view. Consequently, methods of investment assessment were applied. Site selection features concerning climatological conditions, soil requirements and other data were taken from previously conducted analyses (Kajba & Bogdan 2003, Kajba & Katičić 2011). Due to a long-term production cycle, small-scale capital turnover (considering the level of growing stock) and product specificity, an insight into the economic aspects of plantation management is fundamental (Posavec 2003, Keča et al. 2012). The economic analysis of establishment of short rotation plantations in the Republic of Croatia has not thus far been sufficiently scientifically explored and there is currently only a small number of scientific papers addressing this issue (Pašičko et al. 2009, Kajba et al. 2011). Insufficient attention is being paid to the economic aspects when new plantations are planned and established. This case study presents calculation schemes based on dynamic investment appraisal in regard to a complete SRC cycle.

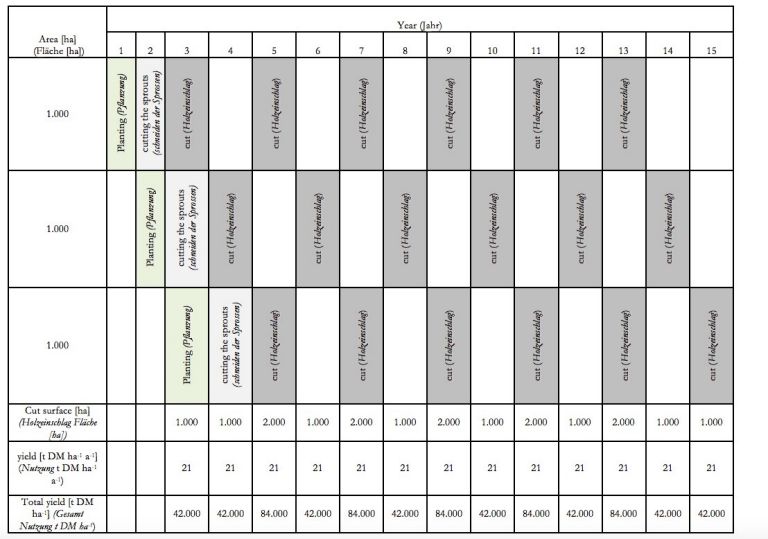

Table 1: Time schedule of establishment of short rotation coppice and production of wood chips with corresponding areas and projected yields / Tabelle 1: Zeitliche Planung der Gründung von Kurzumtriebskulturen und der Produktion von Hackschnitzeln mit den zugehörigen Flächen und geplanten Erträgen

2.1. Research area

The pilot energy plantation (experimental clonal test) that was the subject of the research was established on a 5 ha plot in April 2008 from cuttings taken from the nursery of the Department of Forestry Genetics, Dendrology and Botany located in Valpovo Forest Range Office (Eastern Croatia). The plantation comprises 10 clones created through diverse combinations of hybridization of White Willow (Salix alba L.) and the Chinese Willow (Salix matsudana Koidz.), as well as white willow clones (Salix alba L.). The test was based on a randomized complete block design with four repetitions. Each clone was represented with 30 ramets per repetition at a spacing of 1.30 × 0.8 m (9,615 plants per hectare). The test was performed on a marginal site, i.e. the soil that according to its pedological characteristics is unsuitable for agricultural crops (Kajba et al. 2012).

The time scheme for the establishment of the plantation and the production of wood chips is presented in Table 1. Provided a short rotation plantation of willow has been established in an area covering 1,000 ha at an annual basis, a total of 3,000 ha covered with short rotation plantation of willow would be established over a three-year period. According to the planned rotation period, the cut in short rotation plantations of willow would be performed every two years during the period of 15 years. Upon the share of moisture in the produced wood chips standing at 30% (as assumed within the economic analysis presented in the following chapter) and an average yield of 21 t DM ha-1 a-1(dry mass per hectare per year) at an annualised level, it was projected that 42,000 tons of wood chips would be produced per 1,000 ha.

2.2. Methodology

Capital budgeting or the assessment of cost-effectiveness is the process of identification, analysis and investment project selection in regard to projects where the returns (cash flows) are expected to exceed the time frame of one year (Holopainen et al. 2010). It is a decision-making process on long-term investment into the real corporate assets. The capital budgeting process includes project cash flow forecasting and the assessment of their financial effectiveness through implementation of criteria of financial decision-making comprised in a number of capital budgeting methods, such as IRR and NPV (Orsag 2002). The general objective of investment project assessment is to gain insight as to the justifiability and the economic acceptability of a project. Key features of capital budgeting are the time value of money, the concept of cash flow, discount rate as opportunity costs of corporate investment, as well as risk and uncertainty (Orsag & Dedi 2011). Capital budgeting rules imply specific criteria according to which projects are rejected or accepted. The criteria according to which projects are accepted or rejected are the results obtained through implementation of specific methods of financial decision-making. The assessment of project cost-effectiveness takes into account time preferences impacting on a considerably more realistic and a more accurate project assessment. The assessment of cost-effectiveness is also referred to as a dynamic assessment of effectiveness and the dynamic parameters are calculated using the following preconditions:

• 15-year long evaluation period, due to the land productivity. Typical harvesting rotation periods are between 2 and 7 years, but may also be extended longer. For willow SRC usually after 15 years the cultivation is either replanted or replaced by other crops (Dallemand et al. 2007). Depending on the SRC conditions, yields may be stable for the 5 to 6 two-year rotations and then decrease, once the plantation is getting older.

• Nominal discount rate of 7% (according to the Croatian National Bank (CNB 2016) and Croatian Bureau of Statistics (CBS 2015), and sensitivity analysis with 5%-10 %)

• Annual price increase of 2,9% (the average inflation rate was 2,5% in year 2009, according to the Croatian National Bank report CNB 2016)

• Investment in the establishment of short rotation coppice in equal shares over the first three years so that a willow plantation covering an area of 1,000 ha is established at an annualised level (1/3 of the stand or 1000 ha is in stand establishment phase, 1/3 or 1000 ha stand is growing, and 1/3 or 1000 ha is for cutting, hence a total of 3,000 ha). SRC should ensure continuity of income and delivery of biomass and bioenergy plantations should be located successively at different ages of production cycle and in the same proportion to the area of individual landowner (3 × 1,000 ha).

• Short rotation coppice maintenance costs concerning the cutting maintenance (stooling) and application of herbicides by spraying, to name a few, are planned between the second and the fourth year and costs concerning 1,000 ha of willow coppice are planned for each year;

• Investment into machinery and equipment for logging, transportation and processing of wood chips is projected during the third year;

• Costs related to operation and maintenance of machinery and equipment for logging, transportation and processing are assessed during the period commencing from the third year to the completion of the project;

• Procurement of new fixed assets upon termination of the amortization period;

• Revenues from wood chip production are defined by valorization of wood chip at 30% moisture content totaling 35 €/t FCO forest road (assortments price ex forest road).

The assessment of project cost-effectiveness is shown through several key financial indicators including the projected profit and loss account, cash flow, net financial flow of the project and profitability indicators (payback period, net present value - NPV - and internal rate of return - IRR) according to (Klemperer 2003).

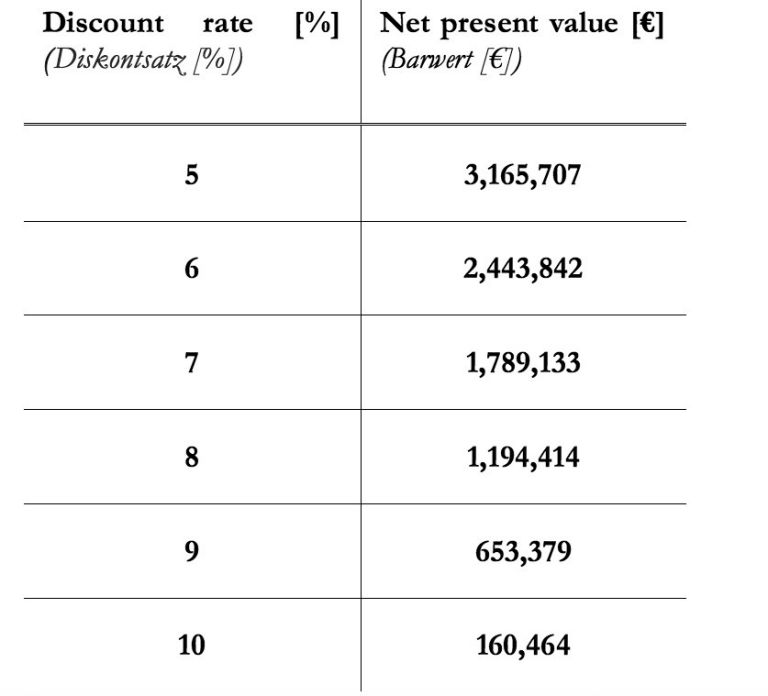

The interest rate of the forest (discount rate) that is opted for during the analysis of forest management has a crucial role for the economic results (Klemperer et al. 1994, Price 1997, Brukas et al. 2001). The significance of the interest rate of the forest is fundamental, since, due to an inadequately selected interest rate, forestry can be ranked amongst activities with no economic justification. The degree of risk in forestry is vital upon the selection of the interest rate of the forest (Brukas et al. 2001). Risky projects are expected to show higher return on invested capital and hence their discount rate is higher in order to realistically show the potential returns. A sensitivity analysis is a technique used to determine how different values of an independent variable impact a particular dependent variable under a given set of assumptions. Sensitivity analysis, also referred to as what-if or simulation analysis, is a way to predict the outcome of a decision given a certain range of variables. This research used an analysis with discount rates ranging from 5% to 10 % in increment steps of 1 % for the NPV calculation.

The total revenues and expenditures, as well as net profit as dependent from the model specification above are documented in Figure 1.

Costs were expected to prevail at the commencement of the investment period, primarily due to capital investment into the lease of land and purchase of machinery (Figure 1). The main costs (table 2) for plot establishment and maintenance are: silviculture costs, planting and seedlings, crop maintenance, land concession, equipment costs with 10% annual depreciation. Opportunity costs are not taken in account in this case study.

Following the first logging after the third year the revenues exceed the expenditures, which does not imply that at that point (after three years) all the invested resources have been recouped. The payback period can be determined only upon taking into account also the time preference of money (Figure 2).

The optimal forest rotation period is influenced by productivity (quality) of the land, the value of the timber produced, the harvesting costs, taxes and administration costs, forest interest rate and non-timber forest products and services (Chang 1983, Terreaux & Peyron 1997, Moog & Borchert 2001, Posavec et al. 2011, Price 2011).

Payback period has been shown both in discounted and in non-discounted terms. The non-discounted amount can be interpreted only as an orientate value, whilst the discounted payback period of return takes into account the risks of work and the time preference of money. Consequently, the discounted payback period provides a more accurate overview of the investment project, because it takes in account inflation rate or nominal interest rate. Additional calculation was performed as shown in Table 3 aiming to establish the cost-effectiveness of the investment at diverse discount rates.

Table 3: Net present value trends in relationship with discount rate / Tabelle 3: Kapitalwert in Beziehung zum Diskontsatz

As expected NPV was lower in case a higher discount rate was used. It is important to highlight that NPV was positive also upon high discount rates (8% -10 %). The results shown in Table 3 confirm the fact that capital investment in SRC (short rotation coppice) has its economic justification and can generate significant profits for the investor. For the purpose of financing and maintenance, as well as logging, transport and biomass chipping from short rotation coppice a loan was required and hence the loan terms were taken over from the Croatian Bank for Reconstruction and Development loan programs intended for projects of this type. All the calculated indicators showed the cost-effectiveness of the project: discontinued payback period 10.83 years, net present value 1,789,133 € and internal rate of return 10.36%.

4. Discussion and conclusions

Biomass potential in Croatia is considerably large and it includes forest residue, wood residue in timber industry, firewood, agricultural residues and the biomass collected upon the maintenance of roads and infrastructure facilities. In addition to forest biomass standing at almost 1.6 mill. m3, which is currently unexploited in Croatian forests in the form of residues, short rotation plantations also have a huge potential. Potential surfaces for establishing short rotation plantations total 1.7 million ha comprising abandoned or marginal forest soil and uncultivated or unsuitable agricultural soil. The research provides a model of establishment of short rotation coppice, commencing from land consolidation, the procurement of planting material up to the wood chip production system. The analysis was performed on the basis of the results obtained from the research conducted in energy plantations of selected willow clones in the Valpovo Forest Range Office. Biomass production potential depended on the soil, selected clones, plant spacing and management of the plantation. All the costs have been shown without subsidies and non-repayable funding and the project can be more cost-effective in the event of subsidies provided. Moreover, it has to be highlighted that project duration is not limited to 15 years as indicated in the analysis but could be extended. Furthermore, it does not need to be restricted to 3,000 ha as shown in the analysis. Concerning the environmental benefits of biomass in relation to fossil fuels through restorability and sustainability, as well as an almost irrelevant atmospheric burden of carbon dioxide upon the use of biomass fuel and the impact of the project on producers, consumers and the local community, it can be concluded that the project of the establishment of short rotation plantations has been economically cost-effective and environmentally and strategically desirable (Richardson et al. 2002).

Economic analysis in this case has its specific features and it differs from the classical analysis of natural forest management. In case of short rotation coppice at the beginning of the investment period, bleak treeless areas need to be afforested, implying substantial financial expenditures for the investors and it simultaneously also implies a risk from planting failure. Moreover, in order to achieve revenue sustainability from these crops, afforestation will not be implemented in one year, but it will be arranged according to plans throughout the years of the duration of one rotation period (e.g. 10 to 15 or 20 years). Due to a faster growth and increment in SRC compared with natural forests, from the financial aspect SRC are considerably more suitable for investment due to a shorter payback period. On the other hand, due to intensive production, presence of only one or few genotypes and artificial regeneration such plantations are more vulnerable to natural disasters. Subsequently, higher discount rates need to be used in case of SRC than is the case upon economic analysis of natural forest management (Beljan 2015). Hence, natural forests imply less risk, yet also a lower internal rate of return (Brukas et al. 2001).

High discount rates can be noted in the example of Paulownia plantations (Paulownia sp. Siebold et Zucc. 1836). This species provides a high rate of growth in wood pulp production and hence also an increase in profit. The uncertainty of such investment is questionable, since the market orientation can instantly change and focus on an alternative species. In this specific case it is obvious that an adequate interest rate of the forest is high and stands at 7% - 8%. Subsequently, it is not recommended to establish short rotation plantations, and the same applies to any other investment in forestry, without prior comprehensive capital budgeting analysis. Short rotation cultures imply investment over a period of time that is substantially shorter compared with the investment in traditional forestry. This research confirms that this type of biomass production, i.e. energy generation from renewable sources is feasible and can generate profit for the investor. There is a possibility to activate some of the unexploited areas and agricultural land in which this type of production could be established in order to enhance rural development, increase the share of energy generated from renewable sources and hence create new jobs.

References

Beljan K., 2015. Economic analysis of even-aged silver fir (Abies alba Mill.) forest management. PhD thesis, University of Zagreb, Croatia, 166 p.

Bogdan S., Kajba D., Katičić I., 2006. Biomass production in willow clonal tests on marginal sites in Croatia (in Croatian). Glasnik za šumske pokuse(5): 261-275

Brukas V., Thorsen B. J., Helles F., Tarp P., 2001. Discount rate and harvest policy: implications for Baltic forestry. Forest Policy and Economics 2(2): 143-156.

CBS, 2015. Croatain bureau of statistics http://www.dzs.hr/.

Chang S. J., 1983. Rotation age, Management Intensity and the Economic Factors of Timber Production: Do changes in Stumpage Price, Interest rate, Regeneration Cost, and Forest Taxation Matter? Forest Science 29(2): 267-277.

CNB, 2016. Croatian National Bank http://www.hnb.hr/en.

Duić N., Juretić F., Zeljko M., Bogdan Z. e., 2005. Croatia energy planning and Kyoto Protocol. Energy Policy 33(8): 1003-1010.

Holopainen M., Mäkinen A., Rasinmäki J., Hyytiäinen K., Bayazidi S., Pietilä I., 2010. Comparison of various sources of uncertainty in stand-level net present value estimates. Forest Policy and Economics 12(5): 377-386.

Kajba D., Krstinić A., Komlenović N., 1998. Arborescent willow biomass production in short rotations (in Croatian). Šumarski list 122(3-4): 139.

Kajba D., Bogdan S. 2003. Experimental Short Rotation Crops in Croatia. In Nicholas, I. D., ed. IEA Bioenergy Task 30 Short Rotation Crops for Bioenergy, Mount Maunganui, Tauranga, New Zealand. pp. 111-113.

Kajba D., Bogdan S., Katičić–Trupčević I., 2004. White willow biomass production in a short rotation clonal test Dravica (in Croatian). Šumarski list 128(9-10): 509-515.

Kajba D., Domac J., Šegon V., 2011. Estimation of short rotation crops potential in the Republic of Croatia: Illustration Case within FP7 project Biomass Energy Europe. Šumarski list 135(7-8): 361-369.

Kajba D., Katičić I., 2011. Selection and breeding of willows (Salix spp.) for SRF. Indian Journal of Ecology 38(Special issue): 91- 94

Kajba D., Pernar R., Ančić M., Šelendić D., 2012. Analiza pogodnih površina i tehnologija proizvodnje biomase u kulturama kratkih ophodnji. University of Zagreb-Faculty of Forestry, Zagreb.

Kajba D., Andrić I., 2014. Selection of Willows (Salix sp.) for Biomass Production. South-east European forestry 5(2): 145-151.

Keča L., Keča N., Pantić D., 2012. Net Present Value and Internal Rate of Return as indicators for assessment of cost-efficiency of poplar plantations: a Serbian case study. International Forestry Review 14(2): 145-156.

Klemperer D. W., 2003. Forest Resource Economics and Finance. McGraw-Hill, 551 p.

Klemperer W. D., Cathcart J. F., Häring T., Alig R. J., 1994. Risk and the discount rate in forestry. Canadian Journal of Forest Research 24(2): 390-397.

Moog M., Borchert H., 2001. Increasing rotation periods during a time of decreasing profitability of forestry — a paradox? Forest Policy and Economics 2(2): 101-116.

Orsag S., 2002. Budžetiranje kapitala-Procjena investicijskih projekata. Zagreb, 308 p.

Orsag S., Dedi L., 2011. Budžetiranje kapitala-Procjena investicijskih projekata [Budgeting Capital-Investment Projects Evaluation] (in Croatian). Masmedia, Zagreb, 416 p.

Pašičko R., Kajba D., Domac J., 2009. Impacts of emission trading markets on competitiveness of forestry biomass in Croatia (in Croatian). Šumarski list 133(7-8): 425-438.

Posavec S., 2003. Bussiness analysis characteristic in management of renewable natural resource-forest (in Croatian). Znanstveni magistarski rad, Ekonomski fakultet Sveučilišta u Zagrebu, 132 p.

Posavec S., Beljan K., Krajter S., Peršun D., 2011. Calculation of Economic Rotation Period for Even-Aged Stand in Croatia. South-east European forestry 2(2): 109-113.

Price C., 1997. A critical note on a long-running debate in forest economics. Forestry 70(4): 389-397.

Price C., 2011. Optimal rotation with declining discount rate. Journal of Forest Economics 17(3): 307-318.

Richardson J., Björheden R., Hakkila P., Lowe A. T., Smith C. T., 2002. Bioenergy from sustainable forestry: guiding principles and practice. Kluwer Academic Publishers, New York, Boston, Dordrecht, London, Moscow, 344 p.

Rosillo-Calle F., 2007. The Biomass Assessment Handbook. Bioenergy for Sustainable Environment. Routledge, London.

Smart L. B., Volk T. A., Lin J., Kopp R. F., Phillips I. S., Cameron K. D., White E. H., Abrahamson L. P., 2005. Genetic improvement of shrub willow (Salix spp.) crops for bioenergy and environmental applications in the United States. Unasylva 51: 51-55.

Sušnik H., Benković Z. 2007. Energy Strategy of the Republic of Croatian in the context of sustainable development of forestry and agriculture (in Croatian). In Krajač, T., ed. Renewable energy in the Republic of Croatia (biomass, biogas from biofuels), Osijek, Croatia. Croatian Chamber of Economy, pp. 11-18.

Terreaux J. P., Peyron J. L. 1997. A critical view of classical rotation optimization. In Moiseev, N. A., ed. Planning and decision making for forest management in the market economy, Göttingen. IUFRO, pp. 181-200.

Tomić F., Krička T., Matić S., 2008. Available agricultural areas and the use of forests for biofuel production in Croatia (in Croatian). Šumarski list 132(7-8): 323-330.

Verwijst T. 2003. Short rotation crops in the world. In Nicholas, I. D., ed. IEA Bioenergy Task 30 Proceedings of the Conference: The role of short rotation crops in the energy market, Mount Maunganui, Tauranga, New Zealand. pp. 1-10.

Volk T. A., Verwijst T., Tharakan P. J., Abrahamson L. P., White E. H., 2004. Growing fuel: a sustainability assessment of willow biomass crops. Frontiers in Ecology and the Environment 2(8): 411-418.